We are in the fourth month of the 2022 bear market as measured from when the S&P 500 first fell -20% from its peak. The initial cause of the bear market, rising interest rates, has not gone away. In fact, rates are going to have to keep climbing in order for the Federal Reserve to keep fighting stubborn inflation. And so the stock market’s most powerful headwind is going to become even more challenging in the months ahead. We therefore expect more erratic price swings as the uncertainty of the Fed’s fight against inflation and the increasing possibility of a recession weigh heavily on investors’ minds.

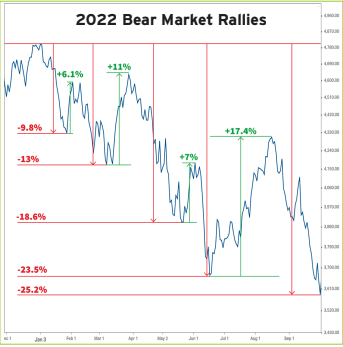

Our approach to this market will continue to be to preserve and protect. The market, as you can see in the Bear Market Rallies chart below, is completely lacking in any trends. The only consistency is inconsistency. Until we see durable trends emerge—our portfolio management software is looking every day at thousands of securities to discover these trends—it is prudent to stay defensive.

Bear markets are discouraging but they are not unusual. The repricing of stocks is violent and volatile and is the cost of investing. However, it leads to more opportunities in the future for diligent investors. Speculative bubbles are popped and expensive areas of the market have and will continue to see their values look more attractive to long term investors.

This year’s bear market is pricing in an economic slowdown brought about by higher interest rates the world over. Higher rates inhibit demand by slowing business and consumer borrowing which both lead to reduced consumption and thus subtract from economic growth. We believe the American economy is best-equipped to withstand what we anticipate to be a global growth slowdown.

We are confident that American business can and will innovate and adapt to this rapidly changing economic environment. We also believe that, notwithstanding this current bear market, stock prices will eventually reflect this confidence as we gradually emerge from this inflation uncertainty and self-imposed economic stagnation.

Bear Market Behavior

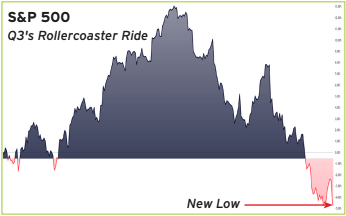

The third quarter saw typical bear market behavior for stocks: dangerous rallies built on nothing more than wishful thinking, whiplash-inducing price swings, and indiscriminate selling of every corner of the market. A chart of the third quarter alone highlights these themes and the wild rollercoaster ride that took stocks higher only to let them drop to fresh new lows.

The market is trendless. The average daily streak of up or down days stands at just two. As expected in a bear market the bias is negative, but this year’s negativity is some of the most intense the market has ever witnessed.

For the S&P 500, over a quarter of this year’s trade days have seen devastating daily drops of over -1%. That’s the third-most in the index’s history. And 57% of this year’s trading sessions S&P 500Q3’s Rollercoaster Ride

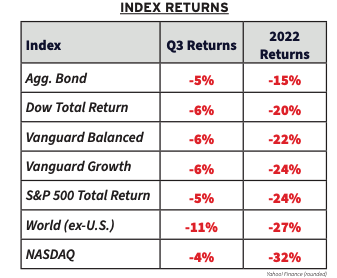

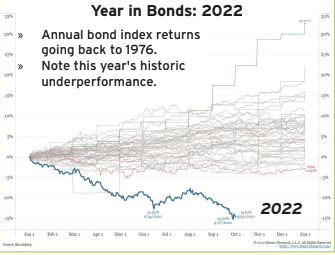

Adding to the challenges facing investors this year is the historically dreadful performance of bonds. Whereas bonds had previously provided insurance to investors by appreciating when stocks fell, both assets are now correlated and decline in value together. The aggregate bond index is having its worst year on record by a factor of 5.

Investors seeking diversification by allocating among stocks and bonds in the standard 60/40 portfolio (60% stocks, 40% bonds) are experiencing the worst performance ever. With inflation, this classic “balanced” portfolio is down -29% for the year.

Rallies & Wishful Thinking

Bear market rallies are a kind of market self-deception. A wishful narrative takes shape and builds on itself until finally it gets exhausted and has to come to terms with reality. This explains the rallies we’ve seen this year, the most punishing of which came over the summer as the S&P 500 climbed 17% only to subsequently fall to a new bear market low.

In the run up to, and during, these rallies the market convinces itself of two things: (1) that inflation has peaked, and (2) that the Fed will be forced to pivot (i.e., that they’ll stop hiking rates and start cutting them). The fact is that inflation remains near 40-year highs and the Fed has been absolutely unambiguous in their goal of crushing inflation no matter the consequences for the broader economy. Interest rates are going to have to keep going up and will have to remain higher for longer. Bear market rallies premised on unfounded assumptions and wishful thinking are unpredictable and fragile. Because of this, rallies built on such unstable foundations cannot reliably, consistently be traded with success.

Volatility has picked up intraday (between market open and close) and also day-to-day as the stock market digests every new economic data point to determine for how long and to what extent interest rates need to rise in order for the Fed to at least pause their fight against inflation.

Good news for the economy is therefore translated as bad news for the stock market because it implies the Fed will need to be more aggressive in its fight against inflation. An economy still running lukewarm means that both inflation and interest rates are going to be higher for longer. This is a toxic combination for stock returns.

No Pivot Coming

The relentless, trendless push and pull we see this year, with breakneck rallies followed by steep drops, is classic bear market behavior. We are in a bear market because of rising interest rates, which themselves are the result of the Federal Reserve’s determination to defeat inflation. The investing cliché, “Don’t Fight the Fed,” is overused but it is a cliché for a good reason: it happens to be true. Every rally the market manufactures in this bear environment is based on directly fighting the Fed, hoping that they don’t really mean what they say and that they’ll reconsider their interest rate hikes soon.

Whereas the Fed could be spooked into a reversal of policy last decade because their hands were tied by both weak growth and ultra-low inflation (they reversed their rate hiking in 2018 because of the Christmas Eve stockmarket crash), the persistence of today’s high inflation has fundamentally changed the Fed’s stance.

High inflation is destructive because it decreases your purchasing power. The dollar in your pocket will buy less tomorrow than it can today. Families suffer as the cost of every-day essentials (food, electricity, gasoline) keep climbing and take up an increasing portion of their budgets. Wages have failed to keep up with inflation—wage growth is running about 2% less than the rate of inflation—putting average Americans at an even greater disadvantage.

Inflation also discourages investment and thus

restrains economic growth as the Fed’s cure, higher rates, make borrowing prohibitively expensive. Untamed inflation wreaks havoc at all levels of the economy, which explains why Fed Chairman Jerome Powell stated that a failure to get it under control would mean “far greater pain” down the road.

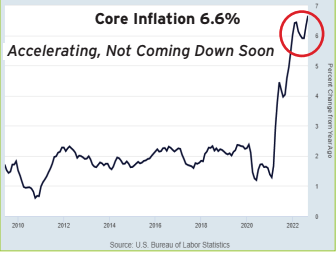

September’s inflation numbers coming in higher especially the acceleration of Core inflation, now up to 6.6%—confirms that inflation has become entrenched and that continued forceful Fed steps will be needed to bring it down. Without any doubt, fighting inflation is the Fed’s sole focus. They are going to hike interest rates to whatever level, and for however long it takes, until they are satisfied prices are coming down.

The Fed has made clear that this process will be painful but that this pain is necesssary for demand to cool and, eventually, for inflation to cool along with it. They’ve concluded that a soft landing (taming inflation with little damage to the economy) is not possible. Regardless of what the stock market might hope, the Fed

is not going to be frightened or intimidated into

reversing course because of the pain that they themselves admit must be inflicted on the econ-

omy in the effort to fight stubborn inflation.

Based on Chairman Powell and other Fed governor statements, it is unlikely that the Fed is going to pivot anytime soon. Until the market learns this lesson we may see more untradeable bear market rallies built on nothing more than wishful, irrational thinking.

Looking Ahead

To a degree not seen since the early 1980s the economy and stock market will go where the Federal Reserve leads them. The Fed, to its credit, is completely honest about the destination: the economy, in Powell’s own words, will experience “a sustained period of below-trend growth.” This below-trend growth will in turn likely lead to muted stock returns and, hopefully, to falling inflation.

We see few catalysts to a sustained upward move in stocks on the horizon. Temporary catalysts may arrive in the fourth quarter with a divided federal government (the stock market has historically performed better when Congress and the Presidency are controlled by opposing parties) and company earnings beating admittedly lowered analyst expectations.

However, the shadow of rising interest rates that hangs over the stock market and the economy is only going to linger around for longer. Higher rates will trigger the Fed’s desired slowdown and likely a recession. A recession will dent business and consumer demand leading to reduced consumption and downsized earnings. Any bear market rallies that arise in the meantime will have a difficult time gaining traction in the face of such significant headwinds.

Our Approach

Often in chaotic bear markets the best way to participate is to avoid. When indexes are trading over -20% from their peaks; when the carnage has spread to all categories of stocks; when bonds are suffering their worst losses on record, it is prudent to let the turbulence run its course instead of being overwhelmed by it.

As we have shown and continue to believe, these rallies so far are built on quicksand. They lack the trends to sustainably lift them out of the bear market and they must fight against the headwind of deep uncertainty relating to inflation, interest rates, and recession.

Avoidance does not mean sitting idly by. Through our portfolio management software we are monitoring prices every day in order to discover durable trends. This discovery process looks back at a specific number of days’ prices to find assets that are (1) reliably appreciating and (2) that are expected to continue appreciating in the near term. In a bear market, with short rallies built on wishful thinking, trends are unstable and unpredictable. As we have seen this year, rallies amount to nothing more than noise.

Until we discover the durable trends that are bound to emerge, we are keeping our powder dry in cash and ultrashort Treasury bonds. Bear markets are the occasional painful cost of investing.

However, bear markets also provide great opportunities to long term investors who can take advantage of discounted asset prices when the recovery inevitably begins. We will remain vigilant in assessing the technicals and fundamentals of this market and will be prepared to reenter should a floor be found and a legitimate rally take off.

Perormance Disclaimer

No investment strategy or methodology can guarantee profits or protect against losses. Investment risk is inherent in every individual portfolio and no computer model or modeling program used or relied upon in making investment choices for a portfolio can eliminate risk.

Sources

◊ https://www.atlantafed.org/cqer/research/gdpnow (GDP estimates)

◊ https://www.bea.gov (GDP data)

◊ https://www.finance.yahoo.com (index returns)

◊ https://fred.stlouisfed.org (economic data)

◊ https://www.ismworld.org (manufacturing and services indexes)

◊ https://www.koyfin.com (index returns)

◊ https://www.sci.isr.umich.edu (consumer sentiment)

◊ David Bahnsen, History Has Spoken—Dividend Cafe, The Bahnsen Group, Oct. 7, 2022, https://bit.

ly/3CKtmL3 .

◊ Alan S. Blinder, The Fed’s Surprising Record With ‘Soft Landings’ From Inflation, Wall St. J., Sept.

23, 2022, https://on.wsj.com/3MIIJIt.

◊ Jason Furman, Stay the Course, Chairman Powell, Wall St. J., Oct. 6, 2022, at A17.

◊ Gwynn Guilford, U.S. Inflation Remained High in August, Wall St. J., Sept. 13, 2022, https://on.wsj.

com/3rkOjqP.

◊ Paul Krugman, Is the Fed Braking Too Hard?, N.Y.Times, Sept. 30, 2022, at A26..

◊ Jerome H. Powell, Chair, Board of Governors of the Fed. Reserve System, Remarks at “Reassessing

Constraints on the Economy and Policy” Symposium (August 26, 2022).

◊ Howard Silverblatt, Market Attributes: U.S. Equities June 2022, S&P Dow Jones Indices, Oct. 4,

2022, on file with author.

◊ Jeanna Smialek, Inflation Defying Efforts From Fed to Cool Economy, N.Y. Times, Sept. 14, 2022, at

A1.

◊ Jeanna Smialek, With Jump in Rates, Fed Shows It Means Business on Inflation, N.Y. Times, Sept.

22, 2022, at A1.

◊ Nick Timiraos, Fed’s Inflation Fight Has Some Economists Fearing an Unnecessarily Deep Down-

turn, Wall St. J., Oct. 8, 2022, https://on.wsj.com/3EZTZhM.