Resources

May 5th 2023 Securities Market Commentary

SummaryThe Federal Reserve raised interest rates for the 10th time in a row, making them the highest in over 15 years. This caused the stock market to drop for four consecutive days. The market is worried about the impact on banks and the overall economy. Inflation is...

How Staying Invested Prevailed Over Market Timing During the Pandemic

Navigating a market downturn can feel like trying to catch a falling knife, and pinpointing the bottom is no easy feat. But, even if you could, re-entering the market could leave a lasting scar on your long-term returns. Picture, for example, an all-stock (S&P...

April 28th 2023 Market Securities

Summary Volatility returned to the stock market this week after a period of calm. Stocks have been trading within a limited range without clear catalysts for further buying pressure. Technology stocks, which have been driving the market's performance this year, are...

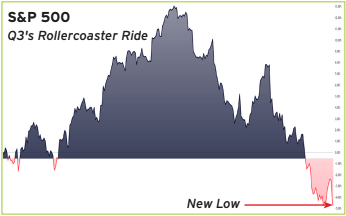

Q3 2022 Securities Markets Commentary

We are in the fourth month of the 2022 bear market as measured from when the S&P 500 first fell -20% from its peak. The initial cause of the bear market, rising interest rates, has not gone away. In fact, rates are going to have to keep climbing in order for the...