Navigating a market downturn can feel like trying to catch a falling knife, and pinpointing the bottom is no easy feat. But, even if you could, re-entering the market could leave a lasting scar on your long-term returns.

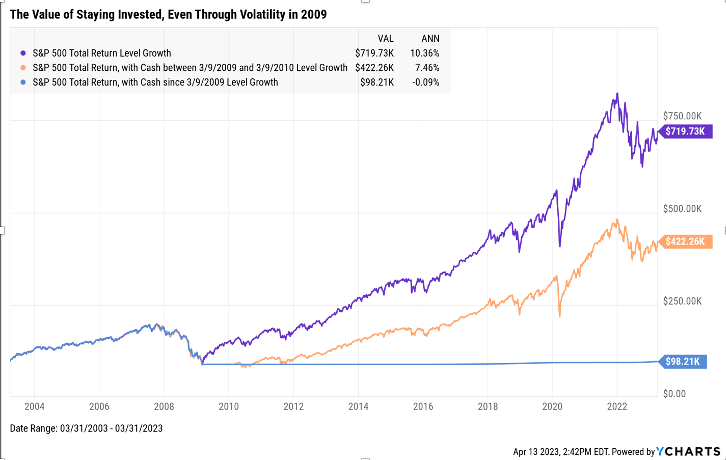

Picture, for example, an all-stock (S&P 500) portfolio spanning 20 years (from Q2 2003 to Q1 2023). If you cashed out at the nadir of the 2008 Financial Crisis and jumped back a year later, you’d be looking at a 7.4% annualized return. Not too shabby. But if you’d just hung in there throughout the turmoil, a buy-and-hold strategy would have resulted in nearly three extra percentage points (2.9%) of return for an annualized return of 10.36%.

Now imagine you bailed at the bottom of the ’08 crisis but never plunged back into the market. That’s when you’d really feel the sting, with a dismal -0.9% annualized return gnawing away at your portfolio.

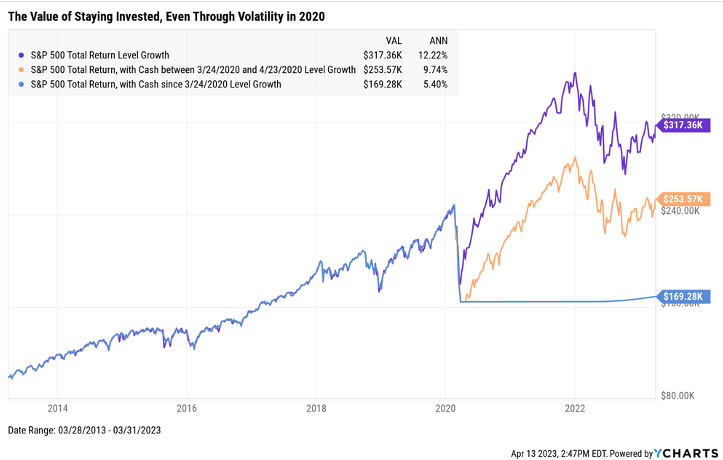

A more recent example is what would’ve happened if you went in and out of the market in 2020. Let’s take a $100,000 investment, using ten years from Q2 of 2013 to Q1 of 2023. If you hopped out of the market for one month at the 2020 pandemic crash’s depths, you’d be looking at a 9.74% annualized return.

This is a fine result, but missing just that one single month in the market meant leaving 2.48% on the table every year compared to the buy-and-hold strategy, which would have netted you a 12.22% annualized return. Those who decided to park their cash at the bottom for good forewent a staggering 6.82% in annualized returns. Talk about FOMO.

©2023 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer, or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument.