Summary

The Federal Reserve raised interest rates for the 10th time in a row, making them the highest in over 15 years. This caused the stock market to drop for four consecutive days. The market is worried about the impact on banks and the overall economy. Inflation is still high, and prices for homes and goods continue to rise. However, some companies are making more money by cutting jobs and raising prices. The housing market is strong, but stocks and small businesses are struggling. The Federal Reserve is unlikely to lower rates unless there is a major problem like a big crisis or recession. Overall, the market is uncertain and cautious. It’s important to resolve the debt ceiling issue before June 1.

Talking Points

Key Takeaways

⇒ Rate hike pause possible, cuts unlikely barring cataclysm.

⇒ Bank weakness across the board (regionals and too-big-to-fails). Resulting tighter credit could

crimp growth.

⇒ Inflation falling but signs of persistence in core measures thanks to housing, labor markets.

⇒ Debt ceiling negotiations urgent given estimates of June 1 X-Date (when government can’t pay

bills)

EXHIBIT 1 – SEASONAL WEAKNESS

The summer stretch from May through September historically sees weaker returns than the rest of the year.

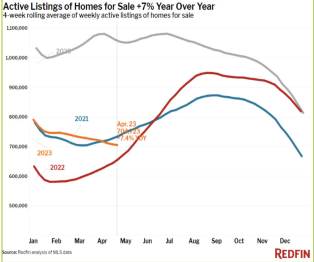

EXHIBIT 2 – A HOLLOW MARKET

Last week we highlighted the market’s weak breadth. We note that with the Nasdaq trading near 6-month highs, only 3% of its constituent stocks are at 6-month highs. And this chart shows the continuing streaks of seeing more NYSE & NASDAQ lows than highs. There’s more going on under the surface.

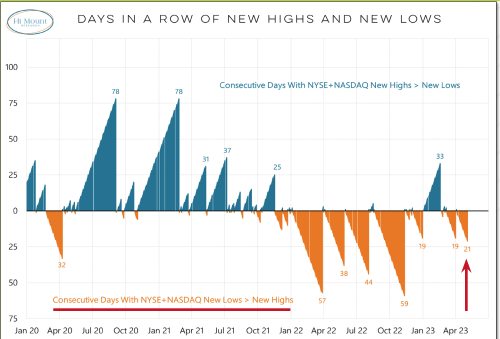

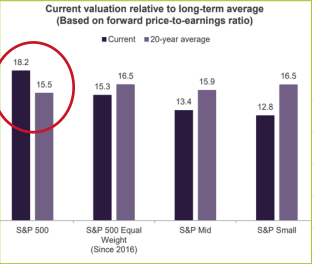

EXHIBIT 3 – LARGE CAP TECH OUTPERFORMING AND EXPENSIVE

Relative to the S&P 500, the tech sector has exceeded heights of outperformance last seen in the Dot Com bubble. Large cap valuations remain well over average even though the S&P is still -14% away from its high.

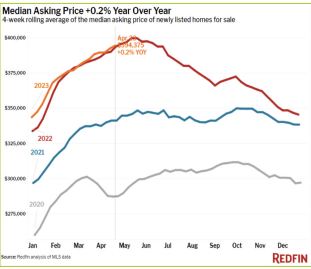

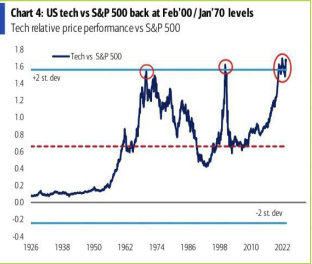

EXHIBIT 4 – INFLATIONARY PRESSURES: HOUSING MARKET

From Redfin we see the median asking price is actually higher than 2022’s record levels. And, below right, we see inventory of active listings falling, which will only contribute to firming home prices.